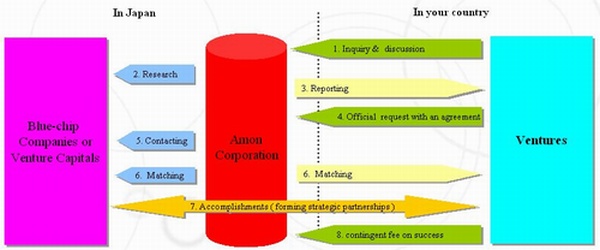

Amon is dedicated to help foreign ventures to raise capital from Japanese strategic partners or seek opportunities of capital tie-ups with blue chip companies at early, growth and pre-IPO stage accordingly.

The ventures would enjoy the following merits to work with us,

Saved your time to negotiate with possible investors

Decision making of Japanese blue chip companies is infamous as slow as a snail although the timing to raise the funds is critical for the ventures. Amon would support the ventures to understand nature of decision making of each Japanese investor and inform you of whether or not investment could be realized even before you start negotiation.

No up-front fee

The ventures don't need to pay any money up-front because Amon adopts a contingent fee system, based on an agreement with the ventures. The fee is only payable if the ventures accomplishments decided in advance such as fund raising or establishing a joint venture from or with the strategic partners.

If you are interested in our service, please send an inquiry at ![]()

|

Sales agent/marketing agent in Japan |

Services for non-Japanese companies |

Market entry support to foreign ventures tapping into the Japanese market |