Corporate finance advisory service to tap into the Southeast Asia

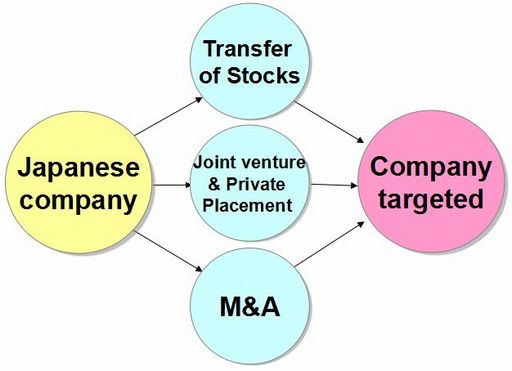

Amon renders a corporate finance advisory service in strategic investments such as transfer of stocks, joint venture establishment, private placement and acquisition for Japanese companies which aim to enter into the Southeast Asia.

Amon focuses basically on the following industries with specialty, knowledge and momentum of Japanese companies.

・Content business (distribution, licensing, BPO)

・Mobile VAS

・Education (online English and ESL school)

・Food & beverage service

・Food process

・Cosmetics & beauty service

・Medical supply & equipment

・Auto aftermarket

・Clean technology (i.e. water and waste water treatment, biomass, e-waste)

・System Integration

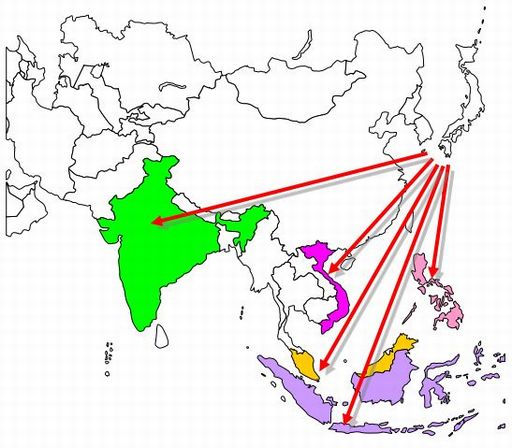

Focused country

Coverage is Philippines, Indonesia, Malaysia, Vietnam and India basically.

Co-advisory system

Corporate finance advisory service for transfer of stocks, joint venture establishment and acquisition could be carried out by both local investment banks or M&A advisers which have deal experience and local knowledge in each country and Amon which can dig up Japanesde clients.

Success (contingent) fee

The fee is only payable if you achieve favorable results or accomplishments (i.e.closing agreement of transfer of stocks, joint venture establishment, private placement and acquisition) decided with Amon in advance.

|

Sales/marketing agent service to tap into the Southeast Asia |

Services for Japanese companies |

Training of LinkedIn-based marketing |